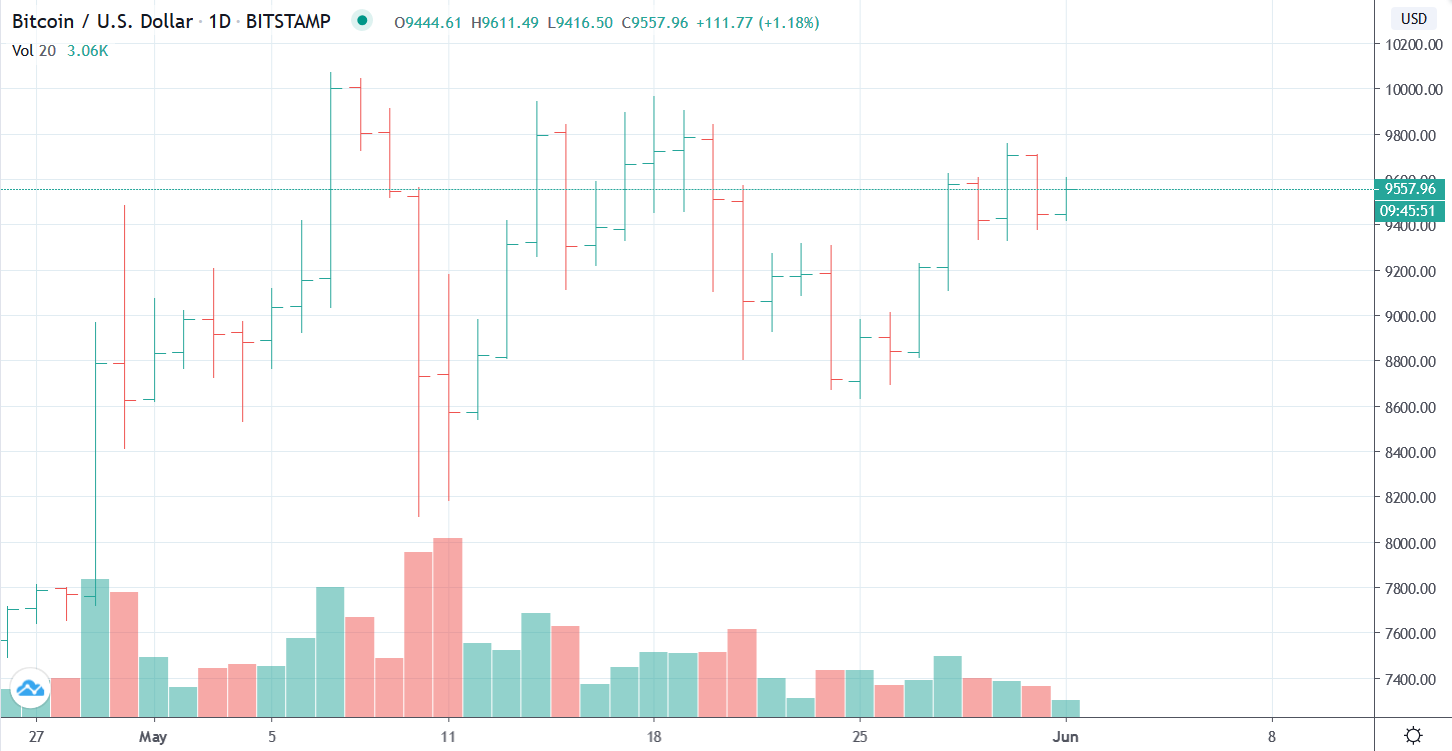

The candlestick chart is a more advanced trading tool containing additional useful information. Higher volume, meanwhile, increases the likelihood that there is some genuine momentum in an upwards price swing. Lower volume means that there is less conviction in the market and a surge outbreak is built on weaker foundations, so the price is more likely to collapse straight back down. This can be a useful indicator of whether or not a surge in prices can be sustained. This is a good indicator of how investors currently view Bitcoin.Īt the bottom of the chart, you’ll find a black line representing historical 24h trading volumes. It’s calculated by multiplying the total number of Bitcoins in circulation by the Bitcoin price. Bitcoin’s market cap simply refers to the total value of all the Bitcoin that has been issued. On the left-hand side of the chart, you’ll see an axis for Bitcoin’s market cap. With a linear chart, you can better judge the speed of price changes, whereas log charts make it easier to identify trends. In the log chart, the crypto price is scaled according to percent changes, so if two price changes are different in absolute value yet equal in percentage, they will both be represented by the same vertical shift on the log scale. In the linear chart, the price scale is divided into equal pieces. You can easily alternate between these by toggling between them (top right hand corner of the graph above, but this will vary). It’s also important to remember that line charts come in two different scales: linear and logarithmic. If you’re a HODLer looking for longer-term investment, monthly will be more suitable.

If you are an experienced trader, you’ll likely want to focus on minutes and hours. Time frames for chart viewing can be measured in whatever length you want to see, whether minutes, hours, days, weeks, months, or years. For cryptocurrencies, these are generally made up of the daily closing prices within a particular time frame.

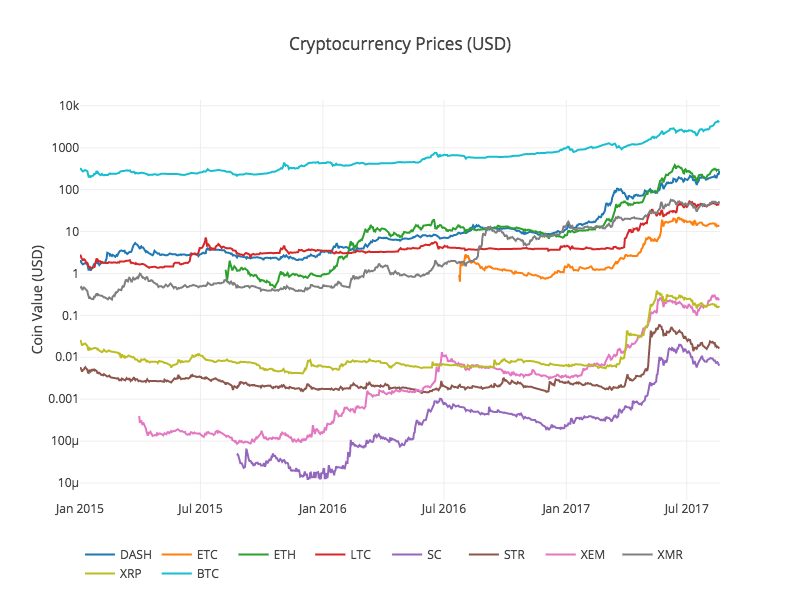

This relates to the scale of the right hand side, representing BTC’s price in USD (though it can display any local currency). You’ll see a green line on the chart above. Line charts display the historical price points of an asset. Line charts are the most basic kind of crypto chart. There are two main formats of price charts used: line charts and candlestick charts. The theory is that this can then be used to help predict where the market is going and what the price will be in the future so you know when to buy, when to sell, and when to HODL. The way the data is plotted can help you see patterns in market movements identify trends as they form and help you to build a picture of the overall momentum of the market – whether bullish (people are buying and the price is going up) or bearish (people are selling and the price is going down). Knowledge is power, and for many traders, charts are integral to their decision-making process.Ī crypto chart is simply a visual tool that displays relevant data in such a way as to help you understand cryptocurrency price movements.

If you’re looking to become a fully-fledged crypto trader, though, these charts can be an incredibly powerful tool when used correctly. There’s a million buzzwords to get your head around, and once you’ve got to grips with those, they hit you with the charts. The world of cryptocurrency can be overwhelming when you’re getting started. Luno always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency. The content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation.

0 kommentar(er)

0 kommentar(er)